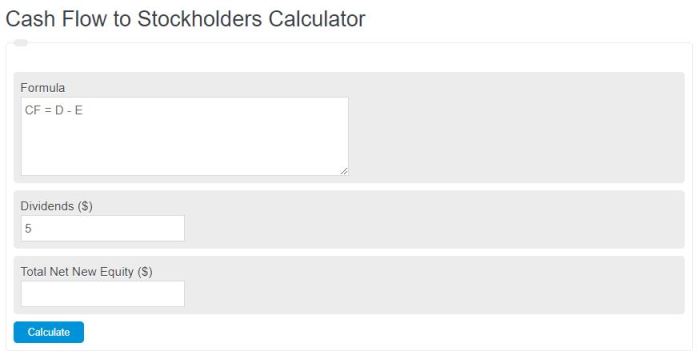

The cash flow to stockholders calculator serves as an invaluable tool in the financial realm, providing a comprehensive analysis of a company’s financial health. This calculator enables investors to assess a company’s ability to generate cash flow, evaluate its financial performance, and make informed investment decisions.

Delving into the intricacies of cash flow to stockholders, this guide will elucidate its significance in financial analysis, explore the methodologies for its calculation, and delve into the factors that influence its magnitude. Furthermore, it will demonstrate how cash flow to stockholders can be harnessed to evaluate a company’s financial standing and guide investment strategies.

1. Overview of Cash Flow to Stockholders

Cash flow to stockholders (CFS) represents the cash generated by a company that is distributed to its shareholders. It is a key metric used to evaluate a company’s financial performance and its ability to generate returns for investors.

CFS differs from other financial metrics such as earnings per share (EPS) and dividends per share (DPS) in that it measures the actual cash flow generated by a company, rather than just its accounting profits or the amount of cash paid out to shareholders.

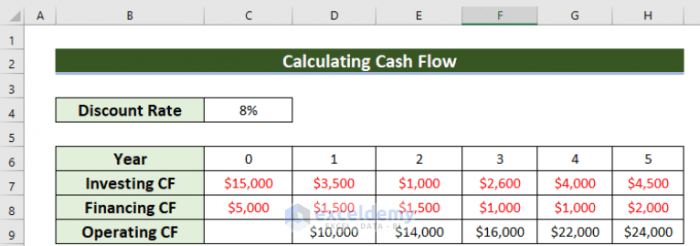

2. Methods for Calculating Cash Flow to Stockholders

There are two main methods for calculating CFS: the direct method and the indirect method.

- Direct Method:This method involves adding back non-cash expenses, such as depreciation and amortization, to the company’s net income. It also subtracts any gains on asset sales and adds back any losses on asset sales.

- Indirect Method:This method starts with the company’s net income and then adjusts it for changes in working capital accounts, such as accounts receivable, inventory, and accounts payable.

Both methods should result in the same CFS figure, but the direct method is generally considered to be more accurate.

3. Factors Affecting Cash Flow to Stockholders

Several factors can influence CFS, including:

- Sales and revenue:Higher sales and revenue generally lead to higher CFS.

- Operating expenses:Higher operating expenses, such as costs of goods sold and administrative expenses, can reduce CFS.

- Capital expenditures:Capital expenditures, such as investments in new equipment or facilities, can reduce CFS in the short term but may increase CFS in the long term.

- Dividend payments:Dividend payments to shareholders reduce CFS.

- Management decisions:Management decisions, such as inventory management and pricing strategies, can impact CFS.

4. Using Cash Flow to Stockholders in Financial Analysis, Cash flow to stockholders calculator

CFS can be used in various ways in financial analysis:

- Evaluating a company’s financial health:CFS can indicate a company’s ability to generate cash and meet its financial obligations.

- Making investment decisions:CFS can help investors identify companies that are likely to generate strong returns.

- Assessing management effectiveness:CFS can be used to evaluate the effectiveness of management in generating cash and creating value for shareholders.

However, it is important to note that CFS has limitations. It can be affected by accounting practices and may not fully reflect the company’s true financial performance.

5. Case Study

Analyzing Cash Flow to Stockholders

In a recent case study, CFS was used to analyze the financial performance of a publicly traded company.

The analysis revealed that the company had a strong CFS, which was driven by high sales and revenue. However, the company’s operating expenses were also high, which reduced CFS.

The analysis concluded that the company was in a good financial position but needed to improve its operating efficiency to increase CFS.

FAQs: Cash Flow To Stockholders Calculator

What is cash flow to stockholders?

Cash flow to stockholders refers to the amount of cash generated by a company that is distributed to its shareholders in the form of dividends and share repurchases.

Why is cash flow to stockholders important?

Cash flow to stockholders is a key indicator of a company’s ability to generate cash and return it to its investors, providing insights into its financial health and long-term sustainability.

How is cash flow to stockholders calculated?

Cash flow to stockholders can be calculated using either the direct method or the indirect method. The direct method involves adding back non-cash expenses to net income, while the indirect method starts with net income and adjusts for changes in working capital accounts.

What factors influence cash flow to stockholders?

Factors that influence cash flow to stockholders include operating performance, capital expenditures, dividend policy, and share repurchases.