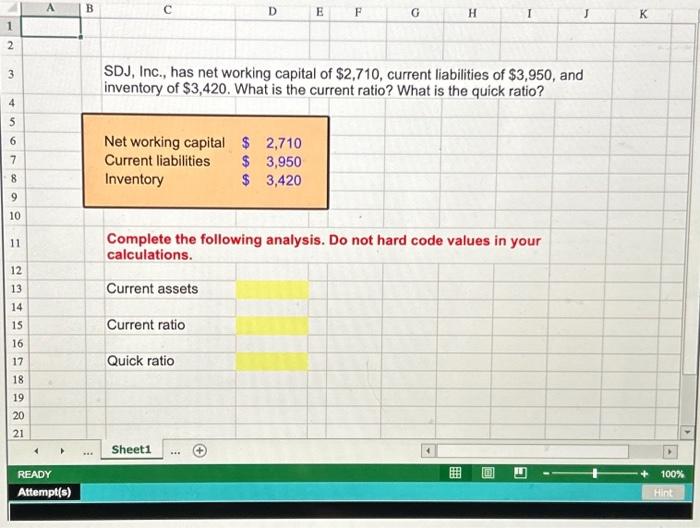

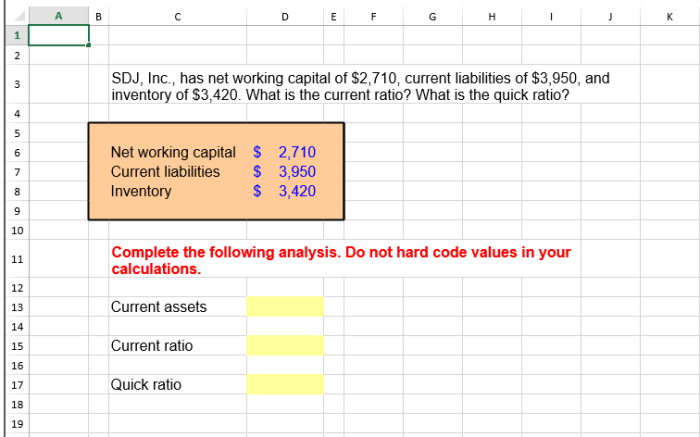

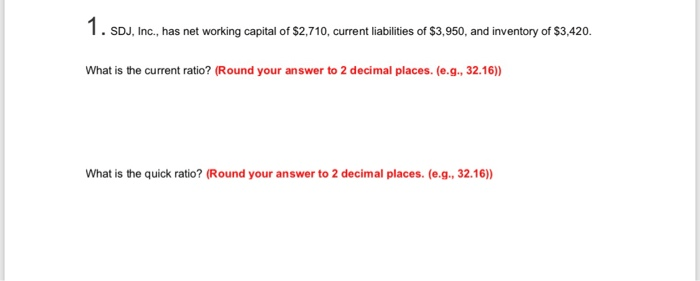

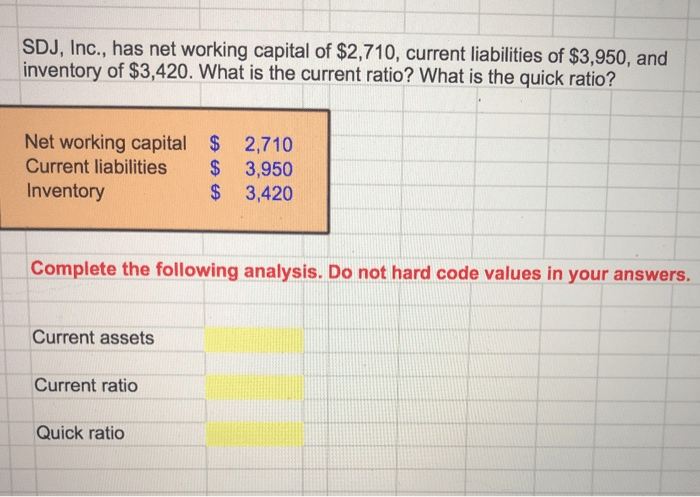

Sdj inc has net working capital of 2710 – With a net working capital of 2710, SDJ Inc. presents a compelling case study for examining the intricacies of working capital management. This in-depth exploration delves into the significance of working capital, its components, and strategies for optimization, providing a comprehensive understanding of this crucial aspect of financial health.

SDJ Inc.’s working capital position is meticulously analyzed, highlighting key metrics and comparing them to industry benchmarks. This comparative analysis provides valuable insights into the company’s strengths and areas for improvement, offering a roadmap for enhancing working capital management and maximizing profitability.

Working Capital Overview

Working capital is a measure of a company’s short-term liquidity and financial health. It represents the difference between current assets and current liabilities, providing insights into a company’s ability to meet its short-term obligations and fund its day-to-day operations.

The optimal level of working capital varies by industry. Some industries, such as retail and manufacturing, tend to have higher working capital requirements due to their inventory-intensive nature. In contrast, service-oriented industries typically have lower working capital requirements.

Components of Working Capital

Current assets include cash and cash equivalents, accounts receivable, and inventory. Cash and cash equivalents provide immediate liquidity, while accounts receivable represent the amount owed to the company by its customers for goods or services sold on credit. Inventory refers to the raw materials, work-in-progress, and finished goods held by the company for sale.

Effective management of current assets is crucial for maintaining a healthy working capital position. Companies must strike a balance between holding sufficient inventory to meet customer demand without overstocking, which can lead to increased carrying costs and potential obsolescence. Additionally, companies must manage their accounts receivable effectively to minimize bad debts and ensure timely collection of payments.

Working Capital Management, Sdj inc has net working capital of 2710

Working capital management involves implementing strategies to optimize the utilization of working capital and improve financial efficiency. Key strategies include inventory control, credit policies, and cash flow management.

Inventory control involves managing inventory levels to minimize holding costs and reduce the risk of obsolescence. Credit policies establish the terms and conditions for sales on credit, including credit limits and payment terms. Effective credit policies can help minimize bad debts and improve cash flow.

Cash flow management focuses on optimizing the flow of cash into and out of the business. This includes managing accounts payable, which represent the amount owed to suppliers, to take advantage of early payment discounts and negotiate favorable payment terms.

Optimizing working capital can have a significant impact on profitability. By reducing the amount of working capital tied up in inventory and accounts receivable, companies can improve their cash flow and reduce their cost of capital.

FAQ Resource: Sdj Inc Has Net Working Capital Of 2710

What is the significance of working capital management?

Working capital management plays a vital role in ensuring a company’s financial stability and operational efficiency. It enables businesses to meet their short-term obligations, maintain adequate liquidity, and optimize profitability.

How can SDJ Inc. improve its working capital management?

SDJ Inc. can improve its working capital management by implementing strategies such as optimizing inventory levels, extending credit terms to customers, and negotiating favorable payment terms with suppliers.

What are the potential benefits of optimizing working capital?

Optimizing working capital can lead to improved cash flow, reduced financing costs, increased profitability, and enhanced financial flexibility.